Financial Planning

What a Certified Financial

Planner Means to You

Schedule a Complimentary Financial Review

Most of us hate talking about our money. That’s because it can seem like there is never enough of it, and we don’t want to live under a budget. When you don’t consider your money, you are free to do with it as you wish. However, when you have no plan for your money, you soon realize that you will forever be chasing it, and you’ll never have the financial freedom you hope to have sooner rather than later. That’s where a certified financial planner (CFP) can help you put a name to your money.

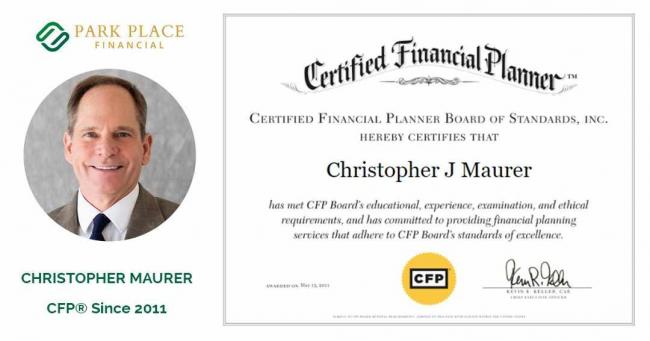

Park Place Financial specializes financial planning services. We are dedicated to helping you meet your financial goals through solid investment management and strategic wealth planning. Our goal is to implement a solid financial plan that meets your needs today, tomorrow, and beyond. Below, we’ll explain a little bit more about what exactly a CFP is and how working with one can help you. Contact us at our Bellaire office today!

WHAT IS A CERTIFIED FINANCIAL PLANNER (CFP)?

In short, a certified financial planner is the highest designation a financial planner can achieve. Owned and operated by the Certified Financial Planner Board of Standards to those who complete their program and meet their requirements. In addition, in order to keep the CFP designation, ongoing educational requirements must be met in order to ensure that those with CFP designation are keeping up with the latest in financial planning trends, tips, and strategies.

CERTIFIED FINANCIAL PLANNER REQUIREMENTS

To earn the CFP designation, a financial planner must meet four requirements:

- Educational requirements

- Pass the CFP exam

- Possess relevant work experience

- Uphold a designated code of ethics

For educational requirements, you must hold a minimum of a bachelor’s degree from an accredited university and complete specific courses in financial planning that CFP has designated. You will have to pass an exam that covers a broad range of topics related to financial planning, such as insurance, risk management, investments, tax planning, retirement planning, and financial planning principles — all financial services that we offer here at Park Place Financial in Bellaire. You must have at least three years of experience in the industry or two years in an apprenticeship role. And you must adhere to the highest standards of conduct by disclosing any criminal convictions, customer complaints, or firings.

WHAT A CERTIFIED FINANCIAL PLANNER MEANS TO YOU

To be frank, anyone can call themselves an investment advisor. If you offer any kind of financial advice to your friend or otherwise, you can be considered an investment advisor. There are other terms that many people go by who are in the financial industry, such as a financial investment advisor, an investment advisor representative, and a certified trust and financial advisor. Park Place Financial understands that these designations can be confusing.

The reality of all this is that all of the above are for investors. None of them look at your entire financial picture and develop plans for your future. They only take care of the management of your investments in the present moment.

A certified financial planner is the most comprehensive planning designation. It shows that your financial advisor is competent in all areas of financial planning, including investments, taxes, and estate planning.

A certified financial planner also commits to a code of conduct and must uphold a fiduciary standard. A fiduciary is simply a fancy word meaning that the clients’ needs always come first no matter what. They are committed to ensuring you have the tools and the education you need to make the right financial decisions for your comprehensive financial plan that will meet your individual financial goals. A CFP will have the necessary training and re-training necessary you need.

CHOOSE PARK PLACE FINANCIAL IN BELLAIRE TODAY

With over 25 years of helping people create financial plans to meet their goals, our certified financial planner creates customized comprehensive financial plans for each client. Our team cares about ensuring you are taken care of in the future and that you don’t outlive your money. When you take advantage of our complimentary consultation, we’ll sit down with you to understand both your short-term and your long-term goals. Then we’ll review your preferences on financial tools to get there. We’ll do our due diligence, performing risk analysis and more, and then offer up our advice on your financial plan. Call today to learn more!